Everything You Required To Know About House Mortgages

Article writer-Omar BernsteinWhen you are buying a new home, it is an exciting time. There is so much to be excited about, but dealing with your home mortgage can be difficult. Finding the best rates and terms is important, as well as paying your mortgage off in a timely manner. Follow the home mortgage tips below to go about your mortgage the right way.

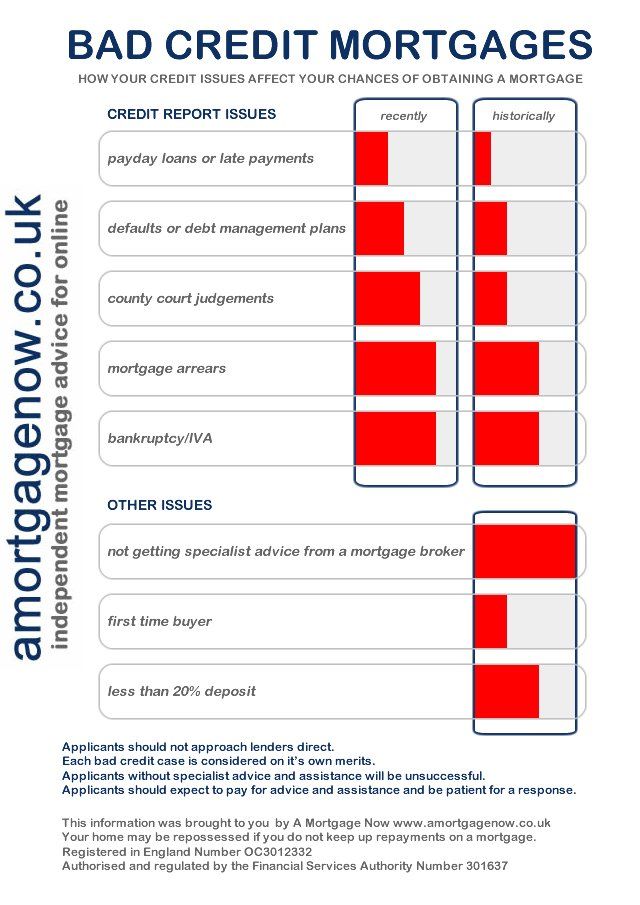

Understand your credit score and how that affects your chances for a mortgage loan. Most lenders require a certain credit level, and if you fall below, you are going to have a tougher time getting a mortgage loan with reasonable rates. A good idea is for you to try to improve your credit before you apply for mortgage loan.

Consider unexpected expenses when you decide on the monthly mortgage payment that you can afford. It is not always a good idea to borrow the maximum that the lender will allow if your payment will stretch your budget to the limit and unexpected bills would leave you unable to make your payment.

Regardless of how much of a loan you're pre-approved for, know how much you can afford to spend on a home. Write out your budget. Include all your known expenses and leave a little extra for unforeseeable expenses that may pop up. Do not buy a more expensive home than you can afford.

Set your terms before you apply for a home mortgage, not only to prove that you have the capacity to pay your obligations, but also to set up a stable monthly budget. This means limiting your monthly payments to an amount you can afford, not just based on the house you want. When your new home causes you to go bankrupt, you'll be in trouble.

Any changes to your financial situation can cause your mortgage application to be rejected. Don't apply for any mortgage if you don't have a job that's secure. If you're in the process of trying to get a loan, make sure you don't switch jobs before you're given one. Lenders will look to see how long you've been in your job position.

Try getting pre-approved for a mortgage before you start looking at houses. This will make the closing process a lot easier and you will have an advantage over other buyers who still have to go through the mortgage application process. Besides, being pre-approved will give you an idea of what kind of home you can afford.

If you are a veteran of the U.S. Armed Forces, you may qualify for a VA morgtage loan. These loans are available to qualified veterens. The advantage of these loans is an easier approval process and a lower than average interest rate. The application process for these loans is not often complicated.

Do not sign a home mortgage contract before you have determined that there is no doubt that you will be able to afford the payments. Just because the bank approves you for a loan does not mean that you could really endure it financially. First do the math so that you know that you will be able to keep the home that you buy.

Know your credit score and verify its accuracy. Identity theft is a common occurrence so go over your credit report carefully. Notify the agency of any inaccuracies immediately. Be particularly careful to verify the information regarding your credit limits. Make all your payments in a timely manner to improve your score.

Know the risk involved with mortgage brokers. Many mortgage brokers are up-front with their fees and costs. Some other brokers are not so transparent. They will add costs onto your loan to compensate themselves for their involvement. This can quickly add up to an expense you did not see coming.

Do not even bother with looking at houses before you have applied for a home mortgage. When you have pre-approval, you know how much money you have to work with. Additionally, pre-approval means you do not have to rush. You can take your time looking at homes knowing that you have money in your pocket.

If you can, you should avoid a home mortgage that includes a prepayment penalty clause. You may find an opportunity to refinance at a lower rate in the future, and you do not want to be held back by penalties. Be sure to keep this tip in mind as you search for the best home mortgage available.

Ask around about mortgage financing. You may be surprised at the leads you can generate by simply talking to people. Ask your co-workers, friends, and family about their mortgage companies and experiences. They will often lead you to resources that you would not have been able to find on your own.

A letter of mortgage loan approval makes for a good impression on sellers, as it demonstrates that you are not just interested but able to buy. It shows that you are already approved, as well. However, ascertain Click Webpage -approval letter includes the amount you are offering. The seller will know you are able pay more if the approval is for a higher amount.

Boost your chances at of a lower mortgage rate by visiting your lender several months before submitting an application. Time is vital in the mortgage process.

Meeting with the lender months beforehand can help you fix issues like credit scores that could raise your rates. Usually when your offer is accepted, you will be quickly heading towards your closing date. This leaves little time to fix anything that could lower your rate.

Think about accepting https://www.marketscreener.com/quote/stock/CREALOGIX-HOLDING-AG-68705/news/CREALOGIX-digitises-funding-applications-for-BAB-the-development-bank-for-Bremen-and-Bremerhaven-39619876/ for a shorter term. The less time it takes you to pay off your home, the less interest you will pay. Of course, you will pay higher monthly payments on a fifteen year mortgage than on a twenty year mortgage, but in the long run you will save many thousands of dollars. Additionally, owning your home outright will give you tremendous peace of mind.

If you don't agree with the lender's assessment made on your prospective home, you can get a second opinion. Of course, you can't tell the original lender to hire another appraisal, but you can apply to another lender. Then you can hope that you get a more favorable assessment from their appraiser.

Now that you've read over this advice, you are ready to get out there and find the right mortgage for your home. You don't want to dive into this situation without the proper knowledge. Instead, you want to be able to make rational decisions along the way and get into the mortgage vehicle that works with you.